This is because the number of profitable growth opportunities for them is limited. It will generate more value for the shareholders if they pay out their net income as dividends. On the other hand, growth companies might pay out minimal or even zero dividends as they can create more value by reinvesting the earnings back into the business. If a company’s stock price has dropped but its dividend payment remains the same, the yield will appear higher. In fact, in some instances, a rising dividend yield could be the sign of a struggling company.

How to calculate dividends – Dividend reinvestment calculator

Suppose that Company B’s stock is trading at $40 and also pays an annual dividend of $1 per share. For example, a company may be better off retaining cash to expand its company so investors are rewarded with higher capital gains via stock price appreciation. Along with REITs, master limited partnerships (MLPs) and business development companies (BDCs) typically can also have very high dividend yields. Treasury requires them to pass on the majority of their income to their shareholders.

Best Brokerage Accounts for Stock Trading

You might also be interested in our APY calculator, which calculates annual interest yield. This dividend calculator is a simple tool that lets you calculate how much money you will get from a dividend when you invest in a dividend-paying stock. This dividend calculator also serves as a dividend reinvestment calculator or DRIP calculator (Dividend ReInvestment Plan). When shopping for dividend stocks, what do i do if my itin number is expired it’s important to keep in mind that a high dividend yield alone doesn’t make a stock a great investment. To the contrary, a yield that seems too good to be true very well could be. If the dividend yield is significantly different than its historical level or is significantly different from similar companies, it can help inform whether a stock is trading for a better — or worse — valuation.

What are dividends and how do dividend yields work?

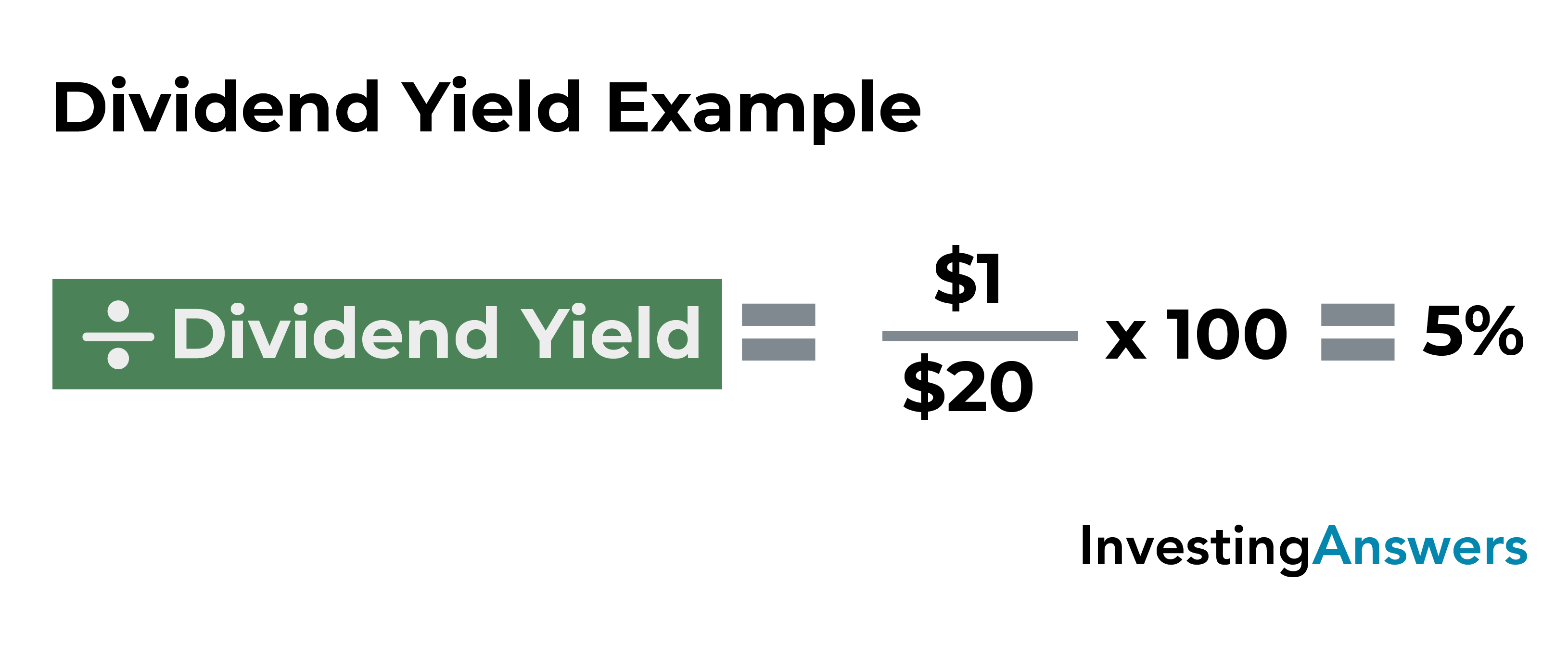

For example, taking the most recent quarterly dividend and multiplying it by four. Alternatively, to take into account changing dividends, an investor can add up all the dividend payments over the prior year. The dividend yield percentage is determined by dividing the dollar value of dividends paid per share in a year by the dollar value of one share of stock and multiplying that figure by 100.

Dividend Yields Make It Easy to Compare Stocks

It’d be remiss to talk about dividend yield without highlighting the tax treatment of dividends. The tax treatment of dividend income varies significantly across different jurisdictions and can ultimately influence investors’ net returns. Because dividend yields change relative to the stock price, it can often look unusually high for stocks that are falling in value quickly. New companies that are relatively small, but still growing quickly, may pay a lower average dividend than mature companies in the same sectors. In general, mature companies that aren’t growing very quickly pay the highest dividend yields. Different companies have different priorities when it comes to distributing profits to shareholders.

It’s most useful as a metric to help determine if a stock trades for a good valuation, to find stocks that meet your needs for income, and to let you know if a dividend may be in trouble. In general, dividends received from foreign investments might be subject to double taxation — once in the foreign country and again in the U.S. However, the U.S. offers a Foreign Tax Credit to mitigate this double taxation, allowing taxpayers to offset the foreign taxes paid against their U.S. tax liability. By analyzing both metrics, investors can assess not only the immediate income potential of a stock but also its long-term dividend sustainability and overall financial health. Yes, the dividend yield percentage is based on the annual dividend of a stock.

Joe’s is listed on a smaller stock exchange, and the current market price per share is $36. High dividend yield stocks, with say 10% or so, are considered risky since a dividend cut is very much on the cards. Investors should carefully choose their stocks and not keep all stocks only, which are high dividend-yielding in nature, as this can have a downside effect in the future. For callable preferred stocks, the yield to worst is the lesser of the current yield and the yield to call. Yield to worst represents the minimum of the various yield measures, across the returns resulting from various contingent future events. The yield to call figure for a callable preferred share is the effective current yield, assuming that the issuer will exercise the call contingency immediately on the call date.

- Dividend yields change and have an inverse relationship to the stock price.

- Our partners cannot pay us to guarantee favorable reviews of their products or services.

- This consistent payout demonstrates that the company generates sufficient profits to share with its shareholders.

- Most stocks pay quarterly dividends, some pay monthly, and a few pay semiannually or annually.

- It should be noted that dividends are not guaranteed and can change if a company runs into financial issues or decides to use its capital for another purpose, such as an acquisition or to pay down debt.

Our estimates are based on past market performance, and past performance is not a guarantee of future performance. Some sectors in their design itself are more conducive to deliver higher dividends to their investors. It is important to understand that it is not an absolute guarantee that companies in these sectors would deliver high pay-outs but they most often do so. Joe’s bakery is an upscale bakery that sells a variety of cakes and baked products in the United States.

It’s up to you to decide how important dividends are to your investment strategy. Remember that dividends can involve some trade-offs, but if you’re evaluating a company for its dividend performance, the dividend yield is one tool you should keep handy. Sectors, including utilities and natural resources, tend to have relatively high dividends. However, other areas of the economy, such as information technology, may provide lower dividends as companies reinvest profits more aggressively in search of growth. This means that investing $1000 with a 7% dividend yield would result in a $144.90 profit after two years and a total of $1,144.90, assuming all the dividends after each year goes into buying additional stock. In the next section, we will show you how to calculate dividend payouts step by step.

SoFi does not guarantee or endorse the products, information or recommendations provided in any third party website. Hence, it is important to check the payout ratio before you make your decision. Company A is likely to become more profitable and, therefore, increase the dividend payout to shareholders.

Let us understand how high dividend yield stocks pay their investors every year in detail with the help of a couple of examples. Let us understand the dividend yield calculator by first understanding the formula to calculate the dividend paid out by a company. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.